Pulsed Field Ablation Market Size, Share & Growth Forecast (2025–2034)

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 10 | Pages : 248 |

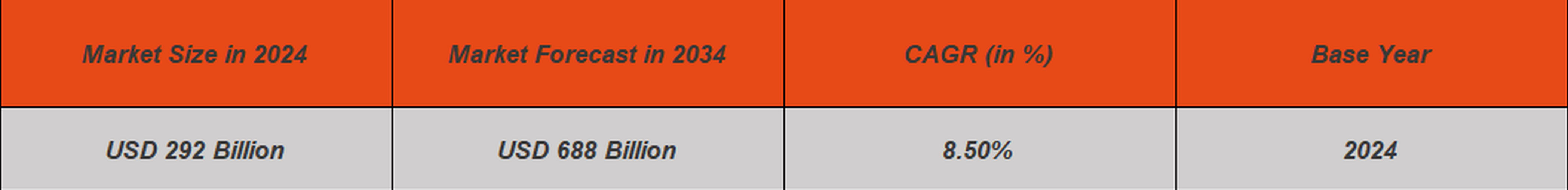

The global insurance broker and agents market was valued at around USD 292 billion in 2024 and is expected to grow steadily, reaching nearly USD 688 billion by 2034. The market is projected to expand at a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period.

This growth is driven by rising awareness of insurance benefits, expansion of health and life insurance adoption, growing corporate insurance needs, and the rapid shift toward digital brokerage and online insurance platforms.

Insurance brokers and agents play a crucial role in the financial services ecosystem by connecting insurance providers with customers. While agents generally represent specific insurance companies, brokers act independently and help customers compare multiple policies to find the most suitable coverage. Their services cover life, health, property, casualty, travel, vehicle, and specialized insurance products.

The market is expanding as individuals and businesses increasingly focus on risk management, financial security, and regulatory compliance. Digital tools, data analytics, and AI-based advisory platforms are transforming traditional insurance distribution models.

The number of insured individuals is increasing due to growing health risks, lifestyle-related diseases, natural disasters, and financial uncertainties. Health and life insurance adoption has accelerated after global health crises and rising medical costs.

Companies are offering insurance as part of employee benefit packages to attract and retain talent. Group health, life, and accident insurance plans are becoming standard across medium and large enterprises.

Online platforms, mobile apps, AI-based chatbots, and digital onboarding tools are enabling brokers and agents to reach wider audiences, reduce operational costs, and improve customer experience.

North America leads the global market due to high insurance penetration, strong healthcare and property insurance demand, and early adoption of digital brokerage platforms. The U.S. dominates regional revenue.

Europe shows steady growth supported by strong regulatory frameworks, social security systems, and high demand for life and health insurance.

Asia Pacific is the fastest-growing region due to rising income levels, expanding middle class, and increasing awareness of insurance in countries like China and India.

These regions are witnessing gradual growth driven by urbanization, digital insurance platforms, and government-backed insurance programs.

The market is moderately fragmented, with major global players holding a significant but not dominant share. The top players together account for around 40–45% of the global market.

The insurance broker and agents market will continue to grow as risk awareness rises across individuals and businesses. Digital platforms, AI-based advisory services, and data-driven customer insights will define the future of the industry. Brokers who adapt to digital-first models and customer-centric services will gain a strong competitive advantage.

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 10 | Pages : 248 |

| Price : US $2800 | Date : Oct 2025 |

| CAT ID : 10 | Pages : 155 |

| Price : US $2800 | Date : Dec 2025 |

| CAT ID : 10 | Pages : 220 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 10 | Pages : 202 |

| Price : US $2000 | Date : Dec 2025 |

| CAT ID : 10 | Pages : 210 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report