800V Electric Vehicle Architecture Market Report 2025–2034: Size, Share, Trends & Growth Forecast

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 220 |

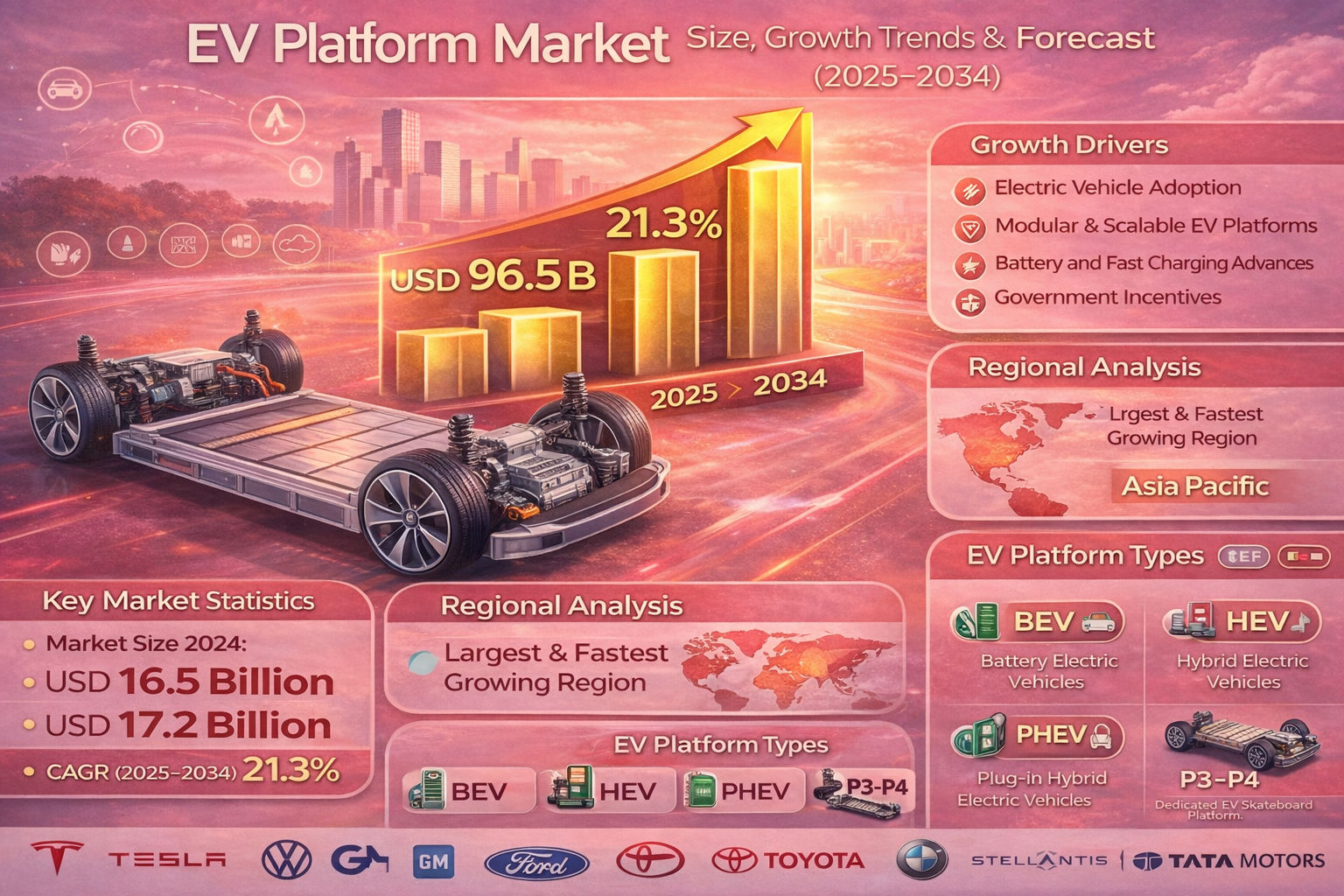

The global EV platform market is witnessing rapid transformation as automakers shift toward software-defined, modular, and scalable electric vehicle architectures. In 2024, the market was valued at approximately USD 16.5 billion and is projected to expand from around USD 17.2 billion in 2025 to nearly USD 96.5 billion by 2034, growing at a robust CAGR of about 21.3% during the forecast period.

This growth is fueled by accelerating electric vehicle adoption, stringent emission regulations, advancements in battery technology, and the industry-wide transition from ICE-based chassis to dedicated EV skateboard platforms. Modern EV platforms integrate batteries, power electronics, software, and autonomous-ready architectures, enabling cost-efficient production and faster time-to-market.

| Parameter | Value |

|---|---|

| Market Size (2024) | USD 16.5 Billion |

| Market Size (2025) | USD 17.2 Billion |

| Projected Market Size (2034) | USD 96.5 Billion |

| CAGR (2025–2034) | 21.3% |

| Largest Region | Asia Pacific |

| Fastest Growing Region | Asia Pacific |

The EV platform market is shifting toward software-defined vehicle architectures, where centralized computing controls powertrain, ADAS, infotainment, and battery management. Dedicated skateboard platforms are replacing converted ICE platforms, enabling higher range, better cabin space, and improved safety.

Automakers are increasingly embedding AI, digital twins, and edge computing into EV platforms to support predictive maintenance, smart charging, and autonomous driving. Platforms such as GM’s Ultium, Hyundai’s E-GMP, and VW’s MEB demonstrate the industry’s focus on scalability, standardization, and cost optimization.

Asia Pacific dominates the EV platform market, driven by large-scale EV production in China, rapid electrification in India, and strong government support. Local OEMs are developing cost-efficient platforms tailored for mass-market and fleet applications.

Europe follows with strong growth due to strict CO₂ regulations, high EV penetration, and platform consolidation strategies by German automakers. The region emphasizes modular, software-centric EV platforms.

North America is experiencing steady expansion supported by federal incentives, large investments in EV manufacturing, and platform-based rollouts of electric SUVs, trucks, and commercial fleets.

The EV platform market is moderately consolidated, with leading automakers controlling over half of global market share. Competition is centered on scalability, battery integration, software capabilities, and time-to-market efficiency.

The EV platform market is expected to remain on a strong growth trajectory as automakers standardize electric architectures and integrate advanced software capabilities. Future platforms will emphasize modular scalability, AI-driven control systems, fast charging compatibility, and seamless integration with autonomous and connected mobility ecosystems.

As EV adoption accelerates across passenger and commercial segments, EV platforms will become the foundation of next-generation automotive manufacturing worldwide.

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 220 |

| Price : US $2800 | Date : Sep 2025 |

| CAT ID : 5 | Pages : 180 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 204 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 275 |

| Price : US $3200 | Date : Jan 2026 |

| CAT ID : 5 | Pages : 221 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report