800V Electric Vehicle Architecture Market Report 2025–2034: Size, Share, Trends & Growth Forecast

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 220 |

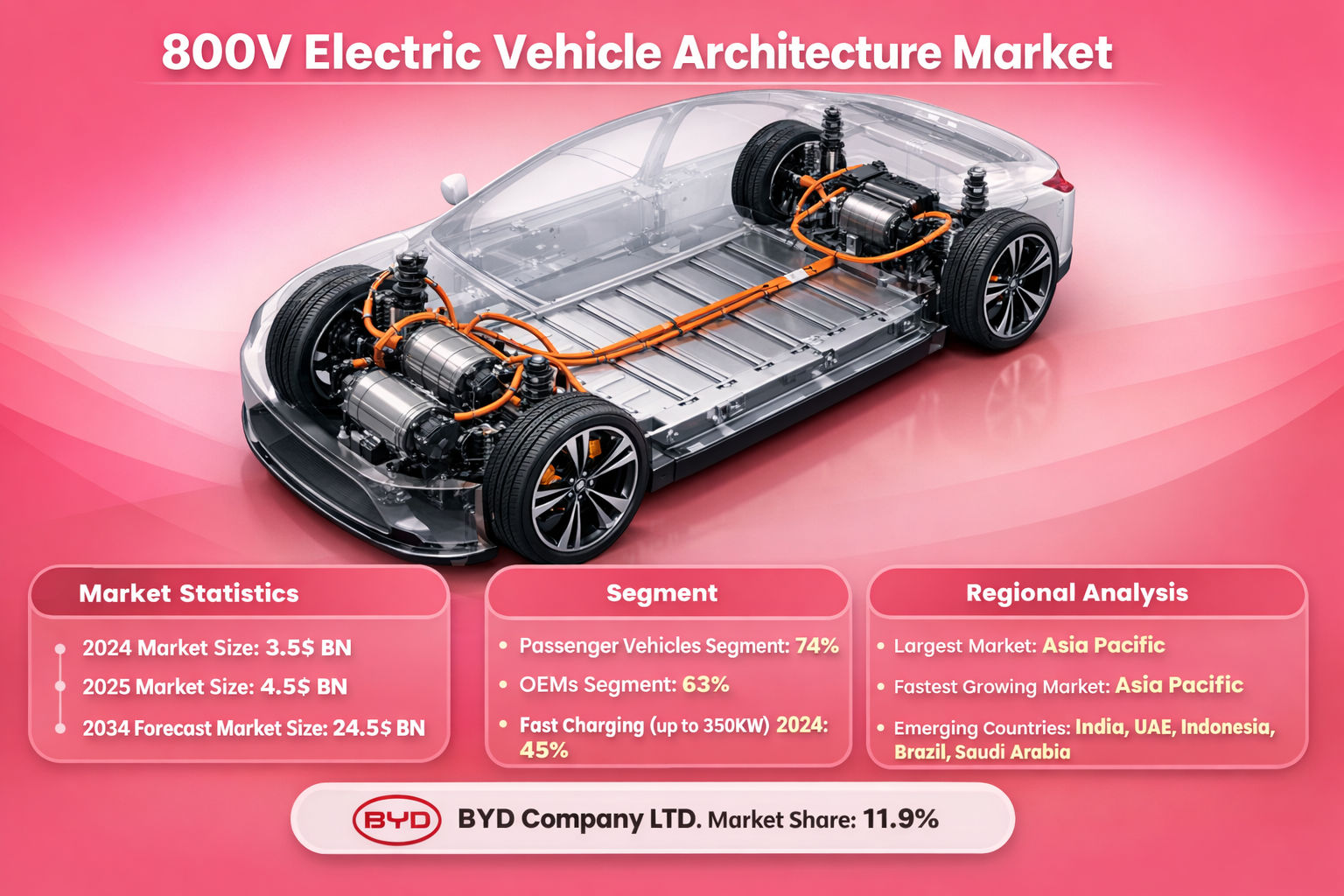

The global 800V electric vehicle (EV) architecture market was valued at approx USD 3.5 billion in 2024 and is projected to grow from around USD 4.3 billion in 2025 to nearly USD 24.5 billion by 2034, registering a strong CAGR of about 21% during the forecast period.

The shift toward 800-volt vehicle platforms is reshaping the EV ecosystem. Compared to traditional 400–450V systems, 800V architectures support ultra-fast charging, lower heat loss, lighter wiring, and higher overall energy efficiency. These benefits make 800V systems ideal for next-generation passenger cars, performance EVs, and commercial electric vehicles that require high power output and minimal charging downtime.

OEMs such as Porsche, Hyundai, Kia, BYD, Lucid, Volkswagen, and Xpeng are actively deploying 800V platforms. At the same time, suppliers like Infineon, ZF, BorgWarner, Bosch, and Siemens are developing silicon carbide (SiC) power electronics, inverters, and onboard chargers optimized for high-voltage operation.

800V systems are moving beyond luxury EVs into mid-range vehicles as component costs decline. Automakers are also shifting toward centralized and zonal electronic architectures to reduce wiring complexity and improve power efficiency. Governments and private players are rapidly installing ultra-fast chargers capable of supporting 800V platforms, making long-distance EV travel more practical.

Asia Pacific is the largest and fastest-growing region, led by China with about 40% regional share in 2024. China’s strong EV manufacturing base, government incentives, and fast-charging rollout support large-scale 800V adoption. India is emerging rapidly due to localization programs and EV policy support.

Europe holds over 25% market share, led by Germany, home to Porsche, BMW, Audi, and Mercedes-Benz. Strict emission laws and dense fast-charging networks support early adoption of 800V systems.

North America holds around 29% share, driven by the US. Companies like Tesla, Lucid, Rivian, and GM are adopting high-voltage platforms. Government funding for fast-charging corridors supports market growth.

Brazil dominates the region due to EV manufacturing expansion and fast-charging projects. The region holds about 5% global share but is growing steadily.

MEA holds around 3% share, led by UAE and Saudi Arabia. Government sustainability programs and luxury EV adoption support growth.

BYD focuses on vertically integrated 800V platforms with in-house batteries. Hyundai and Kia emphasize scalable EV platforms with fast charging. Porsche uses 800V for premium performance EVs. Xpeng and NIO combine 800V with smart and autonomous technologies.

The 800V electric vehicle architecture market will expand rapidly as ultra-fast charging, high-performance EVs, and advanced batteries become mainstream. Continuous innovation in silicon carbide semiconductors, thermal management, and modular vehicle platforms will make 800V systems the foundation of next-generation electric mobility for both passenger and commercial vehicles.

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 220 |

| Price : US $2800 | Date : Sep 2025 |

| CAT ID : 5 | Pages : 180 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 204 |

| Price : US $2800 | Date : Nov 2025 |

| CAT ID : 5 | Pages : 275 |

| Price : US $3200 | Date : Jan 2026 |

| CAT ID : 5 | Pages : 221 |

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

Customize This Report